White House Endorses Raising Tariffs by Over 3X on Chinese Steel and Aluminum Imports

ON 04/19/2024 AT 02 : 11 AM

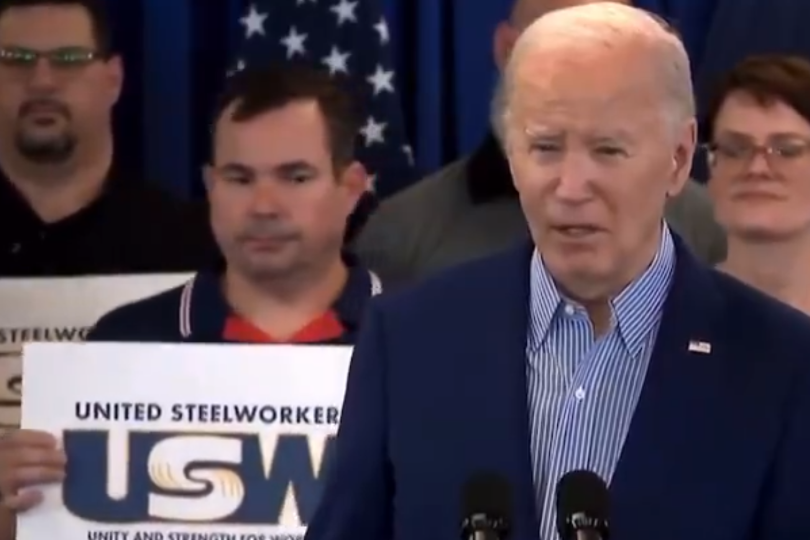

The decision to raise tariffs was disclosed during a pathetic campaign stopover in Pittsburgh, where the broken puppet president was put on display at a campaign rally for members of the United Steelworkers union (USW).

With Pennsylvania expected to be in play in the November elections, the steel making industry and its employees could assume a pivotal role in securing Biden a second term in the White House. With the state being home to 749,000 members of the USW as of the end of 2023, the highest since the last peak of 779,000 workers in 2011, and the union overall representing some 1.2 million workers nationwide, this union could provide the swing votes necessary to the state in the fall elections and contribute 20 of the 270 total electoral votes Biden needs to win.

While Biden’s statements during a campaign event made this clearly a political play for his handlers, raising the tariffs was part of a far more involved response to a grievance the United Steelworkers Union and four other unions filed with the government last month.

In March, the USW filed what is known as a Section 301 petition with the Department of Commerce. It demanded the government investigate and determine remedies regarding violations of international trade laws relating to:

Restrictions of Access to Critical Materials. This part of the complaint notes how China, which currently “produces more than 90% of the world’s supply” of “critical raw materials derived from rare earth elements and other minerals” used in support of some of the fastest-growing industries on the planet. Those include “dozens of vital green technologies – solar panels, wind turbines, advanced batteries, energy efficient lighting, and more”.

“China uses export quotas, taxes, and licensing procedures to restrict exports of these minerals to users in the U.S. and other countries,” the complaint adds. “These restrictions raise prices for manufacturers outside of China, lower prices for those within the country, and create a powerful incentive to shift production to China in order to secure necessary supplies.”

Prohibited Subsidies Contingent on Export Performance or Domestic Content. The petition cites no less than four Chinese government programs the USW claims are unlawful internal business arrangements and funding architected “to benefit its producers and exporters of green technology”. Those programs include:

The “Ride the Wind” Program. According to the USW, this “gives wind power projects that use localized wind power equipment (…equipment produced domestically instead of abroad), access to loan interest subsidies and priority connection to the power grid. Foreign joint ventures operating wind farms that purchase domestic equipment also enjoy preferential treatment in terms of value-added taxes and enterprise income taxes.”

A Special Fund for Wind Power Manufacturing. This fund provides grants to Chinese manufacturers of wind turbines amounting to “about five to ten percent of the cost of a turbine”. To be able to claim the grant, the makers also must demonstrate they sourced “certain designated ‘critical’ components of the turbines” domestically.

A targeted Export Product Research and Development Fund for these kinds of products. This provides companies which export outside of China over half its production and a total market value of those goods of at least $15 million.

Export Credits from China’s Export-Import Bank. These are also a prohibited form of subsidies under international trade laws, and agreements set by the Organization for Economic Co-operation and Development (OECD), a multinational trade association to which both China and the United States are signatory partners.

Export Credit Guarantees from Sinosure. This is a program where exports are guaranteed to achieve a given level of volume and as such constitute another prohibited trade subsidy from China. Though the exact amount of money involved in this program is difficult to determine, back in 2009 the total amount of export credit guarantees China’s Sinosure entity provided to all exporters added up to $99 billion. It is understood to be much larger now. Like the other programs noted above, it also disproportionately supports “green industries” where competition is intense.

Discrimination Against Imported Goods and Foreign Firms. The USW petition notes that China actively dissuades, and disadvantages, imported items and foreign goods which might otherwise compete in many industries through a variety of practices banned by the World Trade Organization. Those highlighted in the filing include:

Mandated Local Content Requirements for Wind and Solar Power Plants. Domestic wind power manufacturers are giving preference over foreign ones, even when cost, quality, or performance capabilities of the alternatives would otherwise make them the better purchase.

Making lucrative Chinese carbon credits earned by domestic manufacturers unavailable to all foreign firms.

Explicit contractual requirements for contracts from Chinese state-owned industries to use domestic content over foreign ones.

In addition to the above, the USW asked the government to investigate illegal trade practices China has in place involving requirements for technology transfer for foreign companies setting up plants in the People’s Republic of China (PRC).

In his speech before the United Steelworkers Union yesterday, Team-Biden referenced the USW petition as a basis for its demand to raise incoming tariffs for imported Chinese steel and aluminum. Its proposal would increase those levies for the 7.5% currently in place on those goods to 25%, for a net increase of over 3 times for any American purchaser of those materials.

Those 7.5% tariffs were imposed while the Trump gang occupied the White House. As with what Team-Biden is about to do, those levies were authorized to protect American business from Chinese exports. The earlier fees applied not just to raw steel and aluminum, but also to value-added goods where imported aluminum and steel accounted for a substantial percentage of the content of certain items, such as automobile and truck body parts.

In addition to the tariffs on the raw materials, Team-Biden is also directing Katherine Tai, at the office of the U.S. Trade Representative, to investigate two other areas where imported Chinese steel and aluminum have caused serious damage to U.S. manufacturers of those commodity goods in recent years.

The U.S. shipbuilding industry, for example, which depends on large quantities of raw stock of both materials for its construction projects, is finding it far more costly to buy from domestic steel and aluminum producers than the Chinese versions, which the USW says can be provided at a lower cost because of the many forms of illegal subsidies described in its government petition.

The second issue Tai is being asked to look into covers how China is shipping far larger amounts of steel and aluminum into Mexico in the past few years. The U.S. government alleges those goods, which it claims are being illegally dumped into Mexico at far lower prices than others could possibly compete with. The allegations extend to that China is using Mexico, which is part of the U.S.-Mexico-Canada (USMCA) trade agreement and offers low tariffs on many goods shipped from Mexico into the U.S. and Canada, effective to “launder” its much cheaper steel and aluminum products either into cheaper products such as entire automobiles made in Mexico, or as parts which lose their national identity in Mexico before being shipped up into the U.S.

If the Mexican trade channel for Chinese aluminum and steel were to be confirmed as an unlawful trade practice, the U.S. Department of Commerce could end up assessing punitive trade sanctions on China and its shipping companies, in addition to raising tariffs on the raw goods themselves.

Another concern the Biden administration is investigating on behalf of American steelworkers is the proposed buyout of U.S. Steel by Japanese-based Nippon Steel for $14.9 billion. In a statement Biden made last month about the acquisition, he declared that it was “vital” this 123-year-old company, which still manufactures steel very much the way it used to as of the beginning of the 20th century, must remain American-owned. The Nippon Steel offer is currently being reviewed by a Treasury Department committee. National security issues are the current focus of that committee’s investigations and concerns, since steel and aluminum are critical to U.S. military and aerospace manufacturing.

The dual-edged sword of increasing trade levies with China so fast may play well with the union, but despite estimates by the Treasury Department that raising them this much will not cause any rise in inflation, past history says the White House will need to be careful in deciding precisely how much the rates will increase to and for how long.

As an example of the consequences of imposing too high a tariff, a study released in 2023 by the Universities of Bonn and Mannheim investigating the repercussions of the Trump era tariffs showed that American importers were hurt far worse by those tariffs than were any of the Chinese industries targeted by them. The detailed calculations in that study showed importers and the American customers who bought from them took 93% of the financial brunt of those tariffs, while Chinese companies saw only a 7% hit to their bottom lines.

Biden’s announcement yesterday that he was looking at a new tariff levy of 25% imposed on steel and aluminum does suggest that the Treasury and Commerce Departments have already made up their minds about what to do. And with the election coming up, the tariffs would likely go in place sooner rather than later, but with impacts on inflation as American buyers take the hit for them lagging for months before they are felt.

The move also provides Biden with some cover over off-the-wall pronouncements by Donald Trump about China. Trump declared in a recent campaign speech of his own that he would raise tariffs on all Chinese goods to 60% if he is reelected. While that would result almost certainly in a catastrophic inflation increase, since it would apply to all Chinese goods including everything from textiles to consumer electronics, autos and auto parts, furniture and more, it is a convenient campaign pledge to show Biden is too soft on China in almost every respect. By having his own counter to that already in place and having enough time to demonstrate its beneficial impacts in the country, Biden could rack up at least one important union endorsement – from the USW – as a result of taking the current trade actions.

Asiabiznews

Asiabiznews